While paper checks aren’t as common as they once were, it’s likely you still receive one occasionally, whether it’s a rebate from a product you purchased or a holiday gift from a relative.

Follow the simple steps below: Open the PSECU Mobile App and select Deposits from the dashboard, then follow the prompts on the screen. The app will automatically populate the To section to have the funds sent to your Checking share. After you’ve made the deposit, you can transfer the funds to a different share. Regions OnePass® Login. Enter your login id and password. Login ID Password.

However common or rare these instances are for you, PSECU’s free mobile deposit feature makes it easier than ever to deposit checks anytime, anywhere using the PSECU Mobile App.

When you use PSECU’s Mobile App, there’s no need to run to an ATM or branch to deposit a check. You can deposit single checks directly to your checking account in a few simple steps by snapping a photo of the front and back of the check with your device. Access to these funds are subject to our Funds Availability Policy.

Get Started Using Mobile Deposit

Ready to get started? Follow the simple steps below:

- Open the PSECU Mobile App and select Deposits from the dashboard, then follow the prompts on the screen.

- The app will automatically populate the To section to have the funds sent to your Checking share. After you’ve made the deposit, you can transfer the funds to a different share.

- In the Front of Check and Back of Check sections, tap on Take Photo and follow the instructions.

- The app will read the check and automatically fill in the Amount section. Verify that the correct information has been populated here.

- When all information on this page has been completed, tap the Confirm Deposit button. You’ll be taken to a confirmation screen that gives you a reference number for the transaction. If your deposit is being held for verification purposes, that information will be displayed here, as well.

Note that you can also access mobile deposit in your Checking share by tapping Mobile Deposit.

Tips for a Successful Mobile Deposit

The first time you use the mobile deposit feature, instructions will pop up after you’ve hit the Take Photo buttons when capturing the front and back of the check. Follow the tips shown here for a successful mobile deposit.

- Front of check

- Place check on a well-lit, solid-colored surface.

- Only deposit checks payable to you or PSECU.

- Verify that the numerical and written amounts match.

- Make sure the check is signed and dated.

- Align the check with the sample check shown in the viewfinder.

- Back of check

- Sign your name in the endorse here section.

- Print the words “For Mobile Deposit Only” underneath your name.

- Align the check with the sample check shown in the viewfinder.

Once you’ve reviewed the on-screen instructions, you can choose to have them hidden in the future by selecting Do Not Show This Again, or you can leave this option unselected so that the instructions appear each time you make a deposit.

Regions Mobile Deposit Not Working

For both the front and back of the check, a sample image will appear in the viewfinder to help you line up your check so that it can be easily read by the app.

After You’ve Made Your Mobile Deposit

Once your mobile deposit is complete, the confirmation screen will display the deposit reference number. Record this number on the back of your check. This will help identify the transaction if you need to call or chat with one of our agents for support.

After your deposit, retain the check in a secure location for a minimum of 30 days and then shred it. Do not deposit this check using any other deposit method.

Frequently Asked Questions

- Can everyone use mobile deposit?

- There are some restrictions for mobile deposit usage. To check your eligibility, visit the Mobile Solutions page in online banking.

- Are there limits on the amount or number of mobile deposits I can make?

- Your deposit limit will display as the “Deposit Amount” after tapping Mobile Deposit.

- There is no limit on the number of checks a member can deposit per day.

- What if I have a check for more than my deposit limit?

- You can call us and ask to be transferred to our Mobile Deposit unit for requests to have deposit limits adjusted.

- What should I do with the check once I submit it through mobile deposit?

- Record the deposit reference number on the back of the check. Retain the check in a secure location for a minimum of 30 days and then shred it. Do not redeposit this check using any other deposit method.

- Why is my mobile deposit being held for review?

- Deposits could be held for various reasons. Here are some of the most common issues:

- The endorsement on the back of the check doesn’t include the verbiage “for mobile deposit only.”

- The endorsement on the back of the check is unable to read the verbiage “for mobile deposit only.”

- The check image could be blurry or unclear when the deposit image is captured.

- The MICR line (numbers across the bottom of the check) couldn’t be read.

- Deposits could be held for various reasons. Here are some of the most common issues:

- What happens if my deposit is held for review?

- This means the application was unable to process the deposit image automatically, and your deposit will require manual review by our agents. You’ll receive email notification once the deposit has been accepted. If the deposit is rejected, the reason will be included in the email notification.

For more tips on using our digital services, visit our blog.

Updated January 14, 2021

Regions Bank has 1,500 branches in 15 states in the South and Midwest. Checking and savings accounts require just $50 to open, with relatively lower requirements to waive fees.

Regions Bank Promotions

Regions Bank frequently offers cash bonuses for new checking customers. Some deals are only available for residents of select States, so make sure you read the fine print carefully.

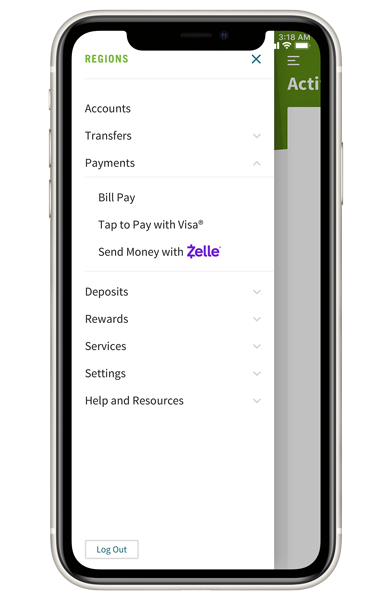

All Regions Bank checking accounts offer free online banking, bill pay, and mobile deposits. There are 2,200 ATMS across 16 states.

Special Checking Account Features

Regions Mobile Deposit Endorsement

Regions checking accounts come with these special features:

- Relationship Rewards. Earn relationship reward points when you do normal banking activities, like using online bill pay, making ATM deposits, etc. You can then redeem rewards for cash, gift cards, travel, and more.

- Regions LockIt. This allows you to block transactions. For example, if you want to control your spending while out for a day, you can lock in-store purchases so you're not tempted. If you lose your card, you can lock all transactions until you find it or report it as lost. You can control this straight on the mobile app.

- Overdraft protection. To help cover overdrafts, you can link your Regions checking account to a savings, money market account, Regions credit card, or Regions personal line of credit. Note: Transfer fees may apply. You must opt in to this service.

What to Open at Regions Bank

- Promotional CDs. If you have at least $10,000 to save, Regions Bank offers a promotional CD with highly competitive rates. You can choose terms of 12-15 months. You must also own a Regions checking account to receive this relationship rate.

- Regions LifeGreen Savings. If you have a Regions checking account, you can open this savings account with no monthly service fee. Opening deposit is $50 if opened online or $5 at a bank. If you set up automated monthly transfers from your checking into this savings, you will earn a 1% annual savings bonus (up to $100/year).

- Now Banking and Cash Solutions. This allows you to manage your money without a Regions checking account. You get a prepaid Visa for purchases. You also get a savings account with no monthly fee and opportunities for savings bonuses. It also offers check cashing services (for a small percentage of the check amount) with immediate access to your funds.

- Student Checking. This account has no monthly service fee and no minimum balance requirements for customers under 25.

How to Avoid Regions Bank Checking Account Fees

Regions Bank Deposit By Phone

- LifeGreen Simple Checking. This account has no minimum balance requirements, but the monthly fee cannot be waived.

- LifeGreen Checking. The $8 monthly fee (with e-statements) can be waived if you: maintain a monthly average balance of $1,500, OR have at least a single recurring direct deposit of $500, OR have combined deposits of at least $1,000.

- LifeGreen eAccess. The $8 monthly fee (with e-statements) can be waived if you make at least 10 Regions debit card and/or credit card purchases per cycle.

- LifeGreen Preferred Checking. The $18 monthly fee can be waived if you: maintain a monthly average balance of $5,000, OR maintain a combined balance of at least $25,000 across all Regions deposit accounts, OR have a qualifying first-lien home mortgage loan, OR have a combined loan balance of at least $25,000 across all Regions loans, lines of credit, and credit cards.

- Life Green Student Checking. This account has no monthly service fee and no minimum balance requirements if you are under 25.

- LifeGreen 62+ Checking. The $8 monthly fee (with e-statements) can be waived if you: maintain a monthly average balance of $1,500, OR have at least a single recurring direct deposit of $300, OR have combined deposits of at least $1,000.